Life Insurance in and around Altamont

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

No one likes to contemplate death. But taking the time now to plan a life insurance policy with State Farm is a way to extend care to your partner if you're gone.

Insurance that helps life's moments move on

Life happens. Don't wait.

Why Altamont Chooses State Farm

Having the right life insurance coverage can help loss be a bit less complicated for the people you're closest to and give time to recover. It can also help cover important living expenses like car payments, retirement contributions and college tuition.

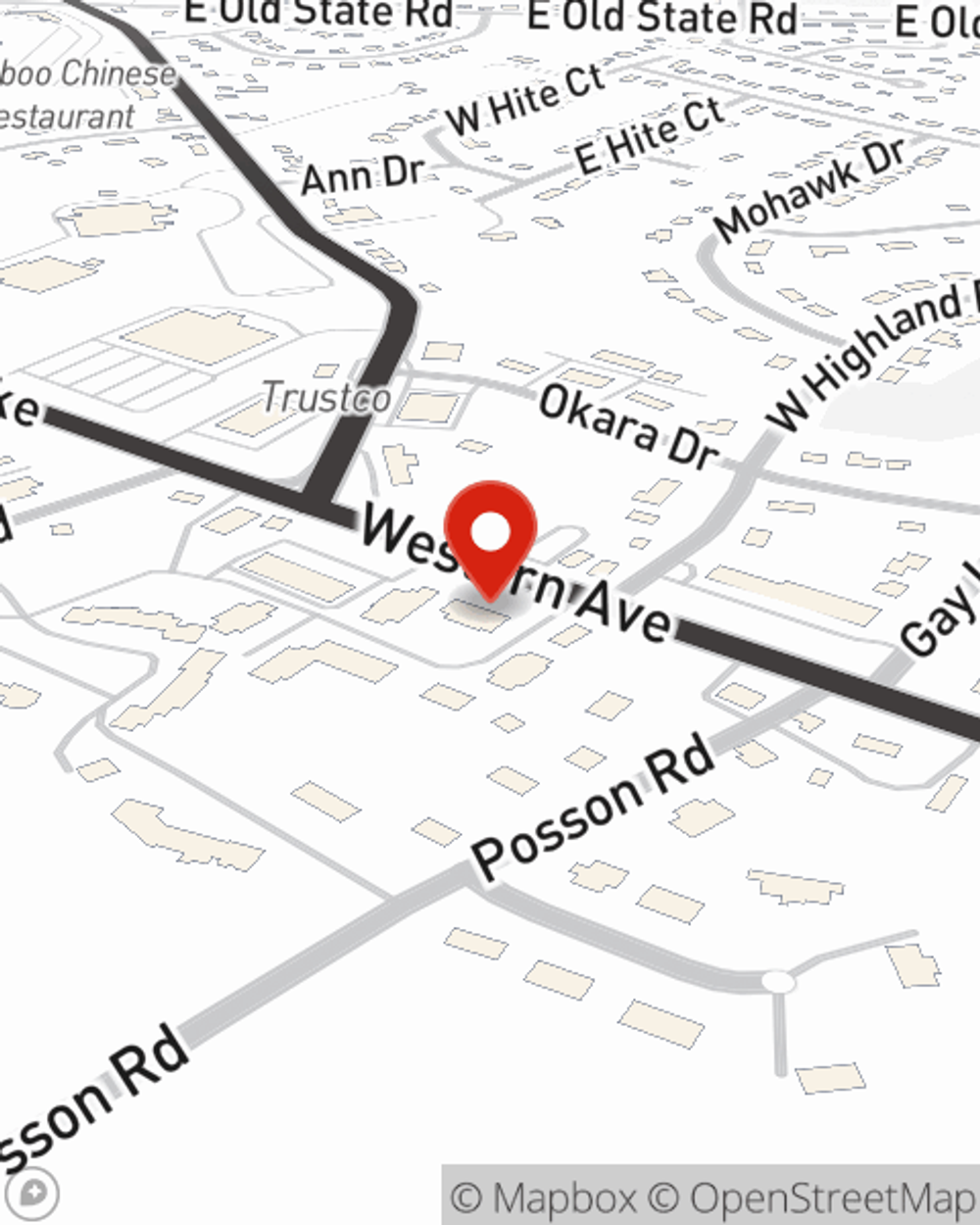

With reliable, caring service, State Farm agent Jolene Kahlor Piazza can help you make sure you and your loved ones have coverage if the unexpected happens. Visit Jolene Kahlor Piazza's office today to learn more about the options that are right for you.

Have More Questions About Life Insurance?

Call Jolene at (518) 486-8700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Jolene Kahlor Piazza

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.